If you’ve recently been in a car accident, you’re probably juggling stress, paperwork, and a dozen unanswered questions. Top Tips for a Smooth State Farm Accident Claim: One of the first things that comes to mind after the dust settles is how to file a claim with your provider and make the process as smooth as possible. Whether it’s your first time or you’re just looking for better guidance, these State Farm Claim Tips will help you stay organized, focused, and on track from day one.

We’re going to walk you through everything you need to know to avoid delays, confusion, and unnecessary headaches when dealing with your State Farm accident claim. You’ll also find practical answers to common questions people ask in situations like yours.

1. Document Everything at the Scene

Right after the accident, your top priority should be safety. Once everyone is okay and the authorities are on their way, start documenting everything. Take photos of the vehicles, license plates, any visible damages, skid marks, road conditions, street signs, and even the surrounding area.

Get the other driver’s contact information, along with details from any witnesses. Top Tips for a Smooth State Farm Accident Claim You might think you’ll remember everything clearly, but the details can get fuzzy after a few days. Having everything on record makes your claim easier to process and strengthens your case from the beginning.

2. File Your Claim Promptly

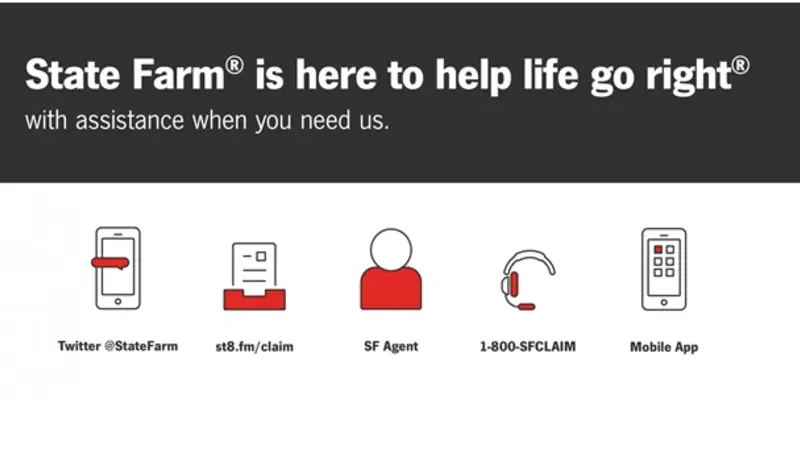

Timing matters more than most people realize. As soon as you’re in a safe space and able to focus, start the claim process. You can do this through the State Farm mobile app, website, or by speaking directly with a representative.

Delaying the claim might lead to missed deadlines or give the impression that the incident wasn’t serious. One of the best State Farm Claim Tips is simply: don’t wait.

3. Be Clear and Honest with the Details

You don’t have to know all the answers, but you do have to tell the truth. Be straightforward about how the accident happened, what you remember, and any damage or injuries. Avoid exaggerating or guessing. If you don’t know the answer to a question, it’s perfectly okay to say, “I’m not sure yet.”

Consistency is key. Any mismatch between your verbal report, written forms, and the evidence you submit might cause unnecessary delays.

4. Keep a Claim Diary

A claim diary is just a fancy name for writing down important updates as they happen. Note the date and time of any calls, emails, or messages related to your claim. Include the name of the person you spoke with, what was discussed, and any action items that came out of the conversation.

Not only does this help you stay organized, but if there’s ever confusion or backtracking needed, you’ll have a clear timeline to refer back to.

5. Understand What You’re Entitled To

A lot of people make the mistake of accepting the first offer they receive because they don’t know what their full coverage includes. Before agreeing to any payment or settlement, take the time to review your policy and ask questions if something doesn’t make sense.

You’re not being difficult by wanting clarity—you’re being smart. This step can help you avoid leaving money on the table.

6. Stay Off Social Media

It might seem harmless to post a quick status update or selfie after an accident, but social media posts can be misinterpreted. Even a simple “I’m okay!” could be used to downplay your injuries or damages.

Until everything is resolved, it’s best to avoid sharing anything about the accident online. When in doubt, keep it private.

7. Follow Through with All Appointments and Repairs

Whether it’s getting a vehicle inspection, seeing a doctor, or visiting a repair shop—don’t skip steps. Ignoring these responsibilities can lead to delays or give the impression that the damage or injuries weren’t serious.

Top Tips for a Smooth State Farm Accident Claim: One of the often-overlooked State Farm Claim Tips is sticking to your schedule and keeping all receipts and documents related to the process.

8. Be Patient—But Proactive

While you want everything handled as fast as possible, some parts of the claim process do take time. That said, you’re allowed to check in, ask questions, and request updates. Being proactive shows that you’re engaged and paying attention.

Set calendar reminders to follow up every few days if you haven’t heard anything. It’s your right to stay informed, and staying in touch keeps the momentum going.

9. Keep All Communications in Writing (When Possible)

Phone calls are fast, but written communication is better for record-keeping. Whenever you can, communicate through email or request written confirmation of anything important discussed over the phone.

Having a paper trail makes it easier to reference exact dates, agreements, or changes in your claim.

10. Don’t Be Afraid to Ask for Help

Whether it’s a close friend, family member, or a legal professional, getting an outside perspective can make all the difference. If something feels confusing or you’re getting stuck, don’t try to push through it alone.

A second opinion can help you make better decisions and catch things you may have missed.

FAQs Top Tips for a Smooth State Farm Accident Claim

1. How long do I have to file a claim with State Farm?

It’s always best to file your claim as soon as possible. While State Farm doesn’t list a strict deadline, reporting the incident promptly avoids delays and makes the process smoother.

2. What documents do I need to support my claim?

You should have:

- Photos of the damage and accident scene

- A copy of the police report

- Medical or repair bills

- Receipts for any related expenses

- Notes from any appointments or follow-ups

3. Can I choose my own repair shop?

Yes, you can typically choose your own repair shop. State Farm may recommend preferred shops, but the final decision is yours.

4. What happens if the other driver is at fault?

If the other driver is found at fault, State Farm may coordinate with their provider to settle the claim. However, you should still file your claim with State Farm to ensure you’re covered from the beginning.

5. What should I do if my claim is taking too long?

Follow up with your representative, reference your claim diary for past communications, and don’t hesitate to escalate if things aren’t moving forward. Staying calm but persistent is key.

Conclusion

Dealing with an accident is already enough stress—you shouldn’t have to feel overwhelmed by the claim process on top of that. These State Farm Claim Tips are designed to keep you ahead of the curve, informed, and confident from start to finish. By documenting everything, being proactive, and staying organized, you give yourself the best chance at a smooth and successful outcome. Whether it’s your first claim or one of many, being prepared makes all the difference. Remember: don’t rush the process, but don’t let it stall either. Stay in control, ask questions, and don’t be afraid to speak up if something doesn’t feel right. You’ve got this. See more